More and more Financial Advisors are realizing the need for long term care planning for their clients or client family members. They are not inclined to dive into the complicated web of this process. They are looking for and benefit from expert advice to assist their clients in making informed decisions on LTC planning and wealth preservation. LTC specialists are uniquely positioned to provide this expertise and add value to the Advisor’s practice.

Why your clients should consider LTC

- Protect retirement funds

- Protect a legacy for beneficiaries and charity

- Provide peace of mind

- Reduce care-giving responsibilities as a concern

- Take advantage of tax benefits. If you have high net-worth clients, they are most likely entrepreneurial and can deduct the LTC premium if it is written through their business (tax treatment/incentives).

LTC vs. Self-Insuring

- Timing: You never know when LTC is needed.

- Liquidity: Is their money tied up into their business, real estate or the stock market? Will there be a state and federal capital gains event?

- The lack of a bona-fide healthcare plan: Who is going the manage the “stuff” that comes along with a loved one with a chronic ailment?

Yes, your client can self-insure and handle an LTC event financially, but this is about healthcare. LTC is not a vehicle for asset protection for wealthy clients. The planning can be considered concierge healthcare. These clients might be sufficiently liquid in the event of an extended healthcare need, but who is going to manage, monitor and adjust their plan of care (with physicians & caregivers)? Before and during a claim, the insurance contract provides the insured access to a team of advocates who can assist in designing, developing and managing a plan of care.

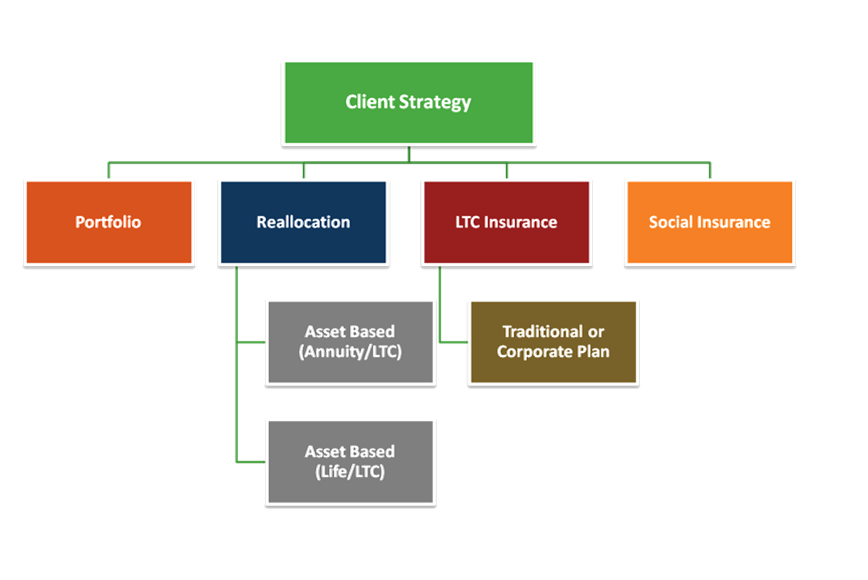

Long Term Care Planning Roadmap