Many employers do not realize there is a huge gap in their employee retirement savings plan – the risk of their employees needing long-term care services. It is critical that employees plan during their working years when insurance is affordable. Employees are looking for confirmation and encouragement to begin the planning process from their employers – the same trusted resource that is helping them plan for retirement. Employer-based long-term care insurance is an essential part of a comprehensive benefits package. From the federal government to the majority of S&P 500 companies, many firms are now offering long-term care insurance to their employees.

It Helps Protect Assets

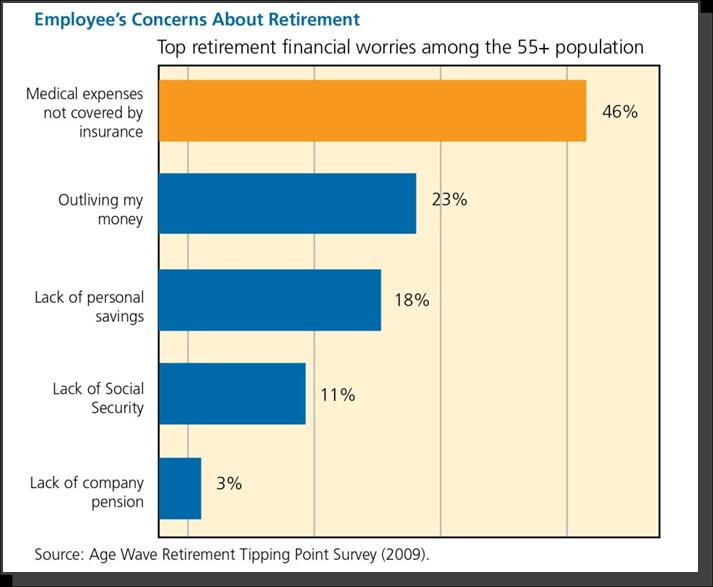

Well-informed and financially savvy people understand the dangers that a long-term care episode can present to their financial portfolios. In fact, paying for a long-term care stay out-of-pocket can be a large contributor to the depletion of assets throughout the retiree population.

It Gives People a Choice About Care

Although Medicare and Medicaid pay for long-term care costs, coverage may be limited. Long-term care insurance policies make it possible to receive care where people want and need it most. Some policies will also pay benefits internationally.

It Eases the Burden on Family Members

Providing care can place an extreme physical, emotional and financial burden on loved ones. Long-term care insurance allows family members to be involved in the care-giving process without being the primary provider.

Burling Insurance Group Long Term Care specialists can assist you from start to finish in implementing corporate, individual, nonprofit, or association long-term care plans.

When one of your employees needs long-term care, or must provide long-term care for someone at home, it can have a great impact on your business. If an employee is providing care for someone at home it is almost as if they have another full-time job.

Health and disability insurance do not pay for long-term care. Health insurance pays for short-term medical care, and disability insurance only replaces a portion of your employee’s income. It does not give them additional money to pay for long-term care.

Why employer sponsored LTC insurance now?

- Workforce reductions and hiring freezes

- Salary freezes and bonus reductions

- Rising healthcare costs/increased co-pays

- Executive retention

- Aging workforce (Sandwich Generation concerns)

- Retiree healthcare costs

Long Term Care insurance is a good idea

- Tax deductions are available if your business contributes to the plan.

- Foster goodwill and improve productivity. Knowing their families are cared for makes it easier for employees to do their jobs.

- Easy to implement.

- Gain a competitive advantage by attracting and rewarding the best employees.

Is it right for your company?

LTC insurance programs are best suited for companies with:

- mid to high salaries

- mid to high average age

- employee interest

- stable core benefit plans